In the area of financial regulation the themes of regulatory changes, consumer protection, competition, risk management and technology change will continue in 2017.

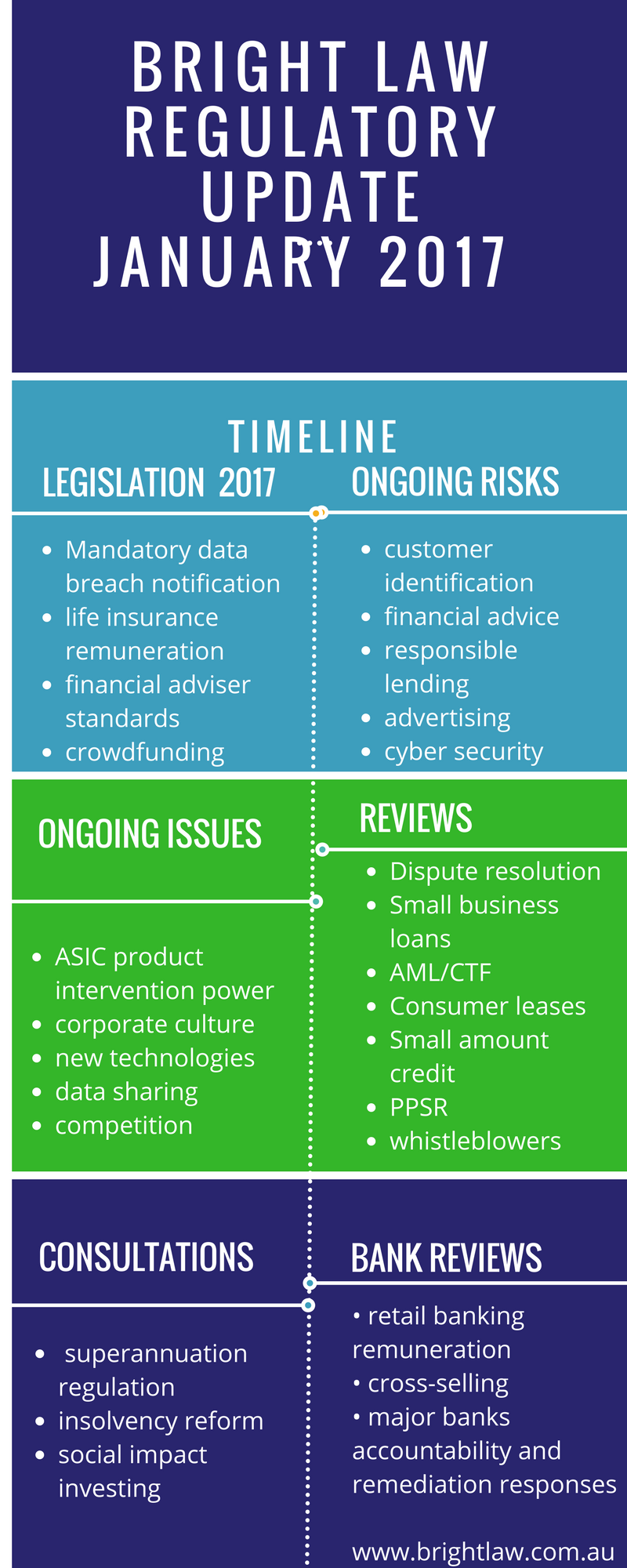

This graphic is a summary of the current issues (click to enlarge).

Bright Law Regulatory Update 1701 (PDF)

Parliament will be considering bills covering the further regulation of financial advisers, mandatory data breach notification and life insurance commissions, and possibly superannuation fund governance.

As the argument over whether there should be a royal commission into banking continues, the Government is continuing its review of the major banks and the external dispute resolution schemes.

The government is also reviewing regulation regarding the designing of new financial products and extending ASIC’s enforcement powers.

ASIC is reviewing remuneration structures of retail banks, including cross-selling.

ASIC’s key regulatory priorities are:

- cyber resilience and technology disruption;

- firm culture and conduct; and

- handling of confidential information and managing conflicts of interest in research and corporate advisory.

With respect to culture, ASIC will continue looking at individual elements of culture in its surveillances, for example, remuneration, breach reporting and complaints handling.

ASIC will consider other areas of focus over 2016–17, including:

- Ensuring client money is appropriately handled;

- Ensuring supervisory frameworks, risk management and controls are in place;

- Reporting suspicious activities.

Summing up, regulatory change is continuing.