Although the Commonwealth Treasurer has announced that the Government will introduce a “financial sector regulatory initiatives grid” to help financial services businesses plan for change by giving them visibility of regulations that might impact their businesses, there is a lack of detail about what it will look like .

It will not change the level of regulation or which regulation is prioritised, only that it intends regulation to be more coordinated both in terms of timing and impact over a rolling, 24‑month forward timeline.

To be helpful the goal has to include communication of information in a meaningful and usable way rather than just a list of proposals and a timeline or an Excel spreadsheet.

It will still be up to businesses to assess the impact on products and executives’ accountabilities and key functions.

The problem with the constant flow of regulation is that it requires continuous system changes

What will be the impact on resources (both money and time) to manage the change and staff training after the change ?

What will be the effect on data retention, reporting and software?

Will it include coordinated tracking as proposals progress from review recommendations, discussion drafts, bills, passed legislation and post-commencement transition implementation?

Currently, there are numerous false starts and changes to proposals.

Reference has been made to the United Kingdom Regulatory Initiatives Grid but that Grid is only a consolidated presentation of the expected change timeframes.

It does not include enforcement actions, nor does it include the majority of supervisory activities or the operational impact of ongoing requirements beyond the implementation stage.

The UK grid states which industry sector the change will affect and whether there be consultation.

The Australian grid is expected to include initiatives of Commonwealth agencies including the Australian Securities and Investments Commission (ASIC), the Australian Prudential Regulatory Agency (APRA), the Australian Competition and Consumer Commission (ACCC), the Reserve Bank of Australia (RBA), and the Australian Taxation Office (ATO). But Treasury, the Privacy Commissioner, Austrac and the Australian Law Reform Commission were not mentioned. It will not include State regulations or international changes.

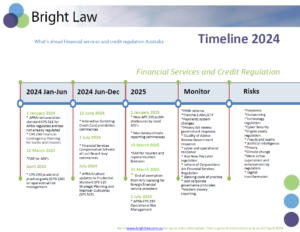

In the meantime here is my latest simplified timeline.

If you found this article helpful, then subscribe to our news emails to keep up to date and look at our video courses for in-depth training. Use the search box at the top right of this page or the categories list on the right hand side of this page to check for other articles on the same or related matters.

Author: David Jacobson

Principal, Bright Corporate Law

Email:

About David Jacobson

The information contained in this article is not legal advice. It is not to be relied upon as a full statement of the law. You should seek professional advice for your specific needs and circumstances before acting or relying on any of the content.