The Treasurer has released the final report of the Review of the Australian Payments System.

The review makes 15 recommendations. Consultation on the recommendations will be conducted by Treasury ahead of the Government finalising a response.

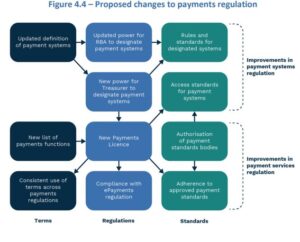

The recommendations include:

- A single, payments licensing framework in line with a defined list of payment functions should be introduced. There should be separate authorisations for the provision of payments facilitation services and the provision

of stored-value facilities, and two tiers of authorisations based on the scale of the activity performed by the payment service provider. Applicants should be able to apply for this payments licence solely through ASIC, without the need to go through multiple regulators. ASIC should coordinate on behalf of licence applicants with other relevant regulators. Ongoing obligations under different authorisations under the licence should remain with the regulators responsible for overseeing those obligations. - The Reserve Bank of Australia (RBA) should be better positioned to regulate new and emerging payment systems that are part of the changing and growing payments ecosystem. Expanding the definition of a payment system will broaden the RBA’s ability to designate new and emerging payment systems under the Payment Systems (Regulation) Act 1998 (PSRA), where it is in the public interest as defined in the PSRA.

- The Treasurer should have the power to designate payment systems and participants of designated payment systems where it is in the national interest to do so. The designation power includes the power to direct regulators to develop regulatory rules and the power for the Treasurer to give binding directions to operators of, or participants in, payment systems.

- A defined list of payment functions that require regulation should be developed. This should be used consistently across all payments regulation. The list should be able to change to ensure it remains fit-for-purpose as technological advancements gather pace.

- The ePayments Code should be mandated for all holders of the payments licence.

- The common access requirements for payment systems should form part of the payments licence to facilitate access for licensees to those systems. The RBA should develop common access requirements in consultation with the operators of payment systems.

- Compliance with technical standards set by authorised industry bodies should be mandatory for payments licence holders. These standards should be aligned with broader payments policy objectives, with the RBA providing authorisation and oversight of industry standard-setting bodies.

- The enhanced Treasury function should take steps to improve coordination between payments regulators, and the alignment of payments regulatory requirements, including with respect to AML/CTF issues.

If you found this article helpful, then subscribe to our news emails to keep up to date and look at our video courses for in-depth training. Use the search box at the top right of this page or the categories list on the right hand side of this page to check for other articles on the same or related matters.

Author: David Jacobson

Principal, Bright Corporate Law

Email:

About David Jacobson

The information contained in this article is not legal advice. It is not to be relied upon as a full statement of the law. You should seek professional advice for your specific needs and circumstances before acting or relying on any of the content.